Copy trading platforms allow you to automatically mirror the trades of other forex traders. It’s as simple as picking a trader to “copy” – every time they buy or sell, your account automatically copies their trades in real-time.

For beginners, the best copy trading platforms can offer a shortcut to the markets without needing to master technical analysis or stare at charts all day, allowing you to learn by observing how pros manage risk and react to volatility.

Copy trading is sometimes pitched on social media as a "set it and forget it" solution for passive income. However, blindly following traders on a leaderboard can be a recipe for disaster. If the trader you copy employs a high-risk strategy or refuses to cut losses, your account suffers the same fate – often faster than you can react.

With over 25 years of experience as a forex trader, I’ve reviewed hundreds of brokers and dozens of copy trading platforms. Check out my picks below for the best copy trading platforms for traders of all experience levels.

I’ve been testing copy trading software since the early pioneers launched in the 2000s, watching the industry evolve from basic signal sharing to complex social ecosystems. I've used my firsthand experience to shine a spotlight on copy trading platforms that prioritize ease of use and transparency over marketing fluff.

Top broker picks for copy trading

1. eToro – Best copy trading platform

| Company |

Copy Trading |

MetaTrader 5 (MT5) |

cTrader |

eToro eToro

|

Yes |

No |

No |

eToro, long known as a copy trading innovator, is my top choice for copy traders in 2026. eToro's easy-to-use platform allows traders to duplicate the trades of more than 2.5 million investors, with a growing list of supported asset classes including stocks, exchange-traded securities, forex, CFDs, and popular cryptocurrencies.

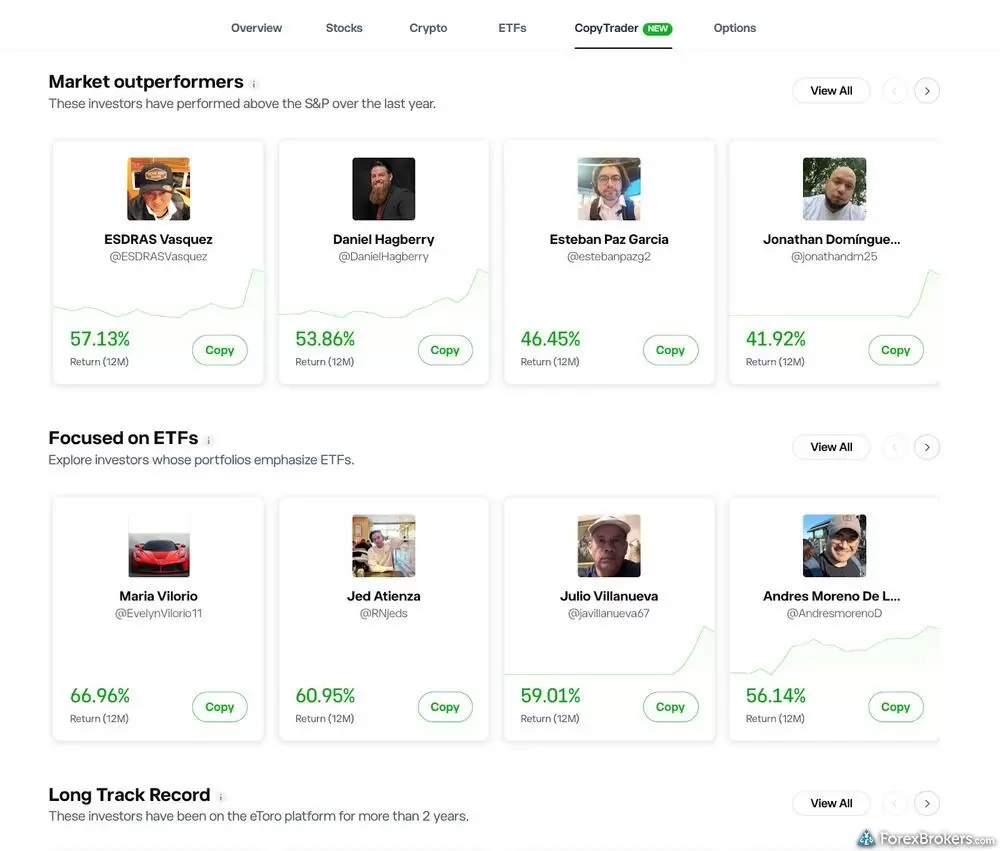

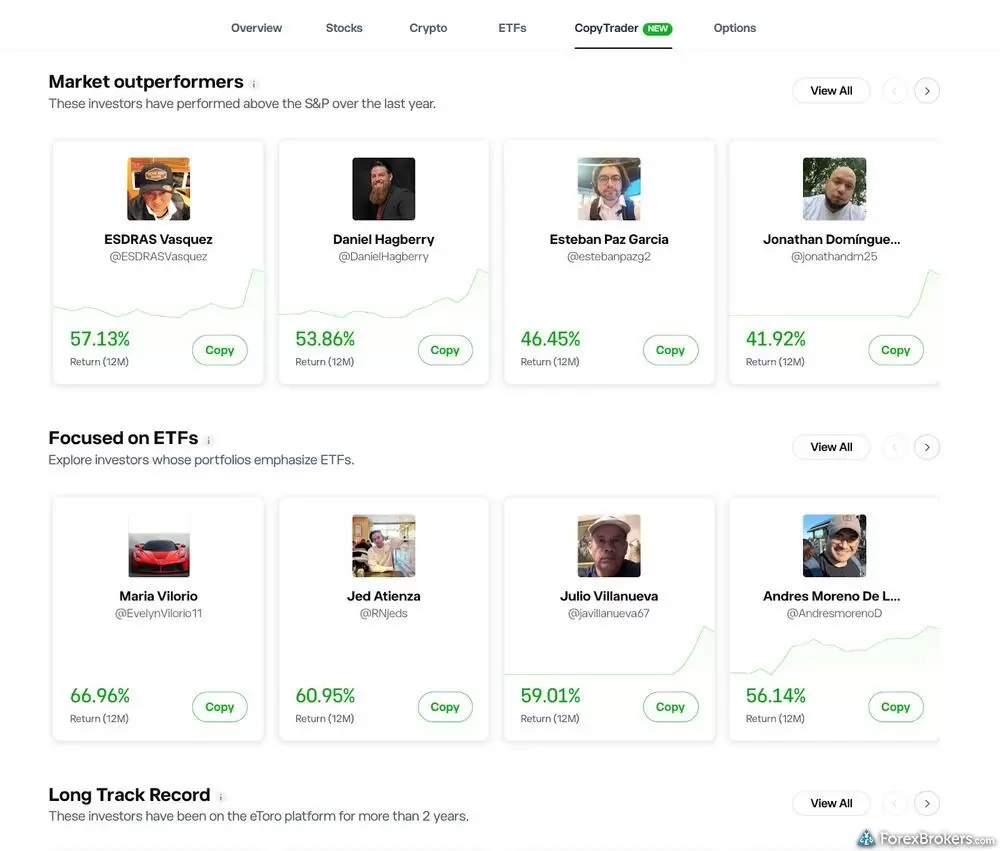

Finding traders to copy: Copy trading is deeply ingrained in the eToro experience. I appreciate the number of search tools and customizable parameters that help you find top-performing investors to copy. Given the massive list of over 2.5 million traders in its database, I've been impressed with how eToro has made it easier to filter out the best investors based on their performance rankings with predefined search lists.

Social network experience: eToro's vibrant community feed, which allows allows traders and popular investors to share and comment on posts, is directly integrated into its platform. The CopyPortfolios tool allows you to copy a pre-packaged selection of other popular investors. This innovative feature helps eToro truly stand out from other copy trading platform providers as a true social trading platform.

eToro Club: In order to crowdsource the best traders to share their strategies for others to copy, eToro has a popular investor program that rewards you when you have consistent risk-adjusted returns. The program ranges from its base tier, Cadet, all the way up to its highest tier, Elite, each with increasing perks such as rebates.

Pricing: eToro remains slightly pricier than most of its competitors, despite recently cutting spreads and introducing zero-dollar commissions for U.S. stock trading. However, I feel that the extra cost of marked-up spreads is offset by the fact that you are receiving eToro’s copy trading services for free.

Steven's take

"Long known for innovation in copy trading, eToro remains the best choice for copy traders in 2026. Even with millions of traders in its database, eToro’s powerful search filters help you cut through the noise and find traders to copy. "

Steven Hatzakis

Within eToro's copy trading experience, it's easy to find traders you might want to copy. In this screenshot, you'll see that you can specifically choose to follow traders who have outperformed the S&P 500.

Note: Past performance is not an indication of future results. Copy trading does not amount to investment advice. Copy trading takes place in a self-directed account, and your capital is no less at risk. The value of your investments may go up or down.

2. Vantage – Great variety of copy trading platforms

| Company |

Copy Trading |

MetaTrader 5 (MT5) |

cTrader |

Vantage Vantage

|

Yes |

Yes |

No |

Vantage earns high marks for its broad selection of copy trading platforms, giving copy traders a diverse set of options to match their risk tolerance and trading preferences. The wide platform variety and growing signal provider network make Vantage a smart pick for traders seeking flexibility and depth in their copy trading setup.

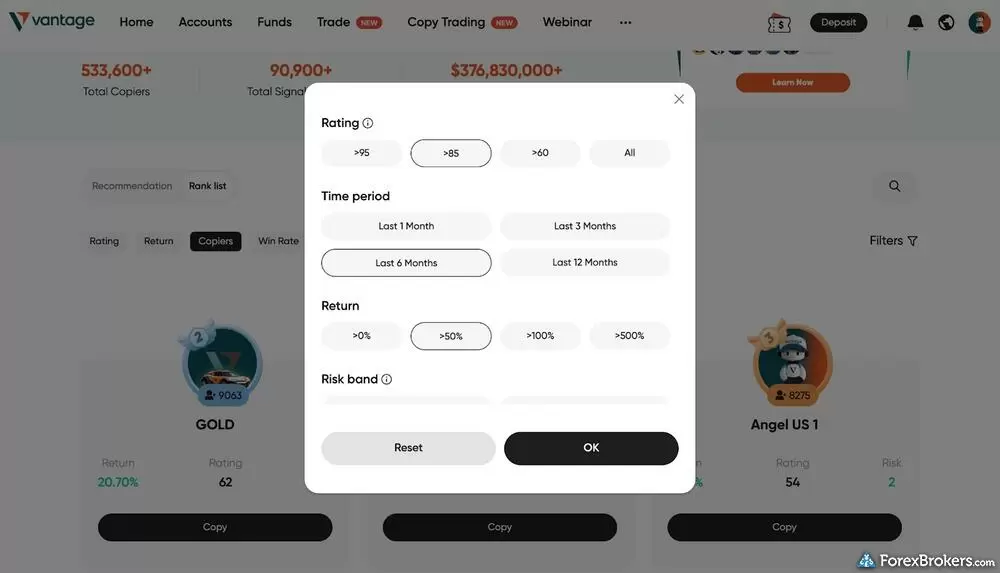

Platform availability: In addition to supporting the Signals Market on MetaTrader 4 and MetaTrader 5, Vantage offers access to DupliTrade, Myfxbook AutoTrade (where available), and its own proprietary Vantage Copy Trading platform, which boasts a growing community of over 90,000 signal providers. .

Vantage Copy: Over the past year, the Vantage Copy platform has added additional reporting and performance statistic tools, providing more insight into the trading results of a given signal provider. This lets you analyze the historical performance at a glance, for a given signal provider.

I appreciate being able to gauge the max drawdown (on a daily, yearly, and monthly basis) while looking over the results of a provider. Vantage also offers a Risk score for each provider, to rank how conservative or aggressive their trading has been, based on their historical trades. This is a nice touch that helps you quickly decipher all the results on the page.

Platform integration: The integration of TradingView with MetaTrader gives users powerful charting options, while its SmartTrader add-ons and plugins help elevate the standard MetaTrader experience. I especially like the additional plug-ins available from OneClickFX – they can add serious utility for power users.

Pricing: While spreads on the Standard account are less competitive, the Raw ECN account keeps costs in line with industry norms and offers decent value for active copy traders.

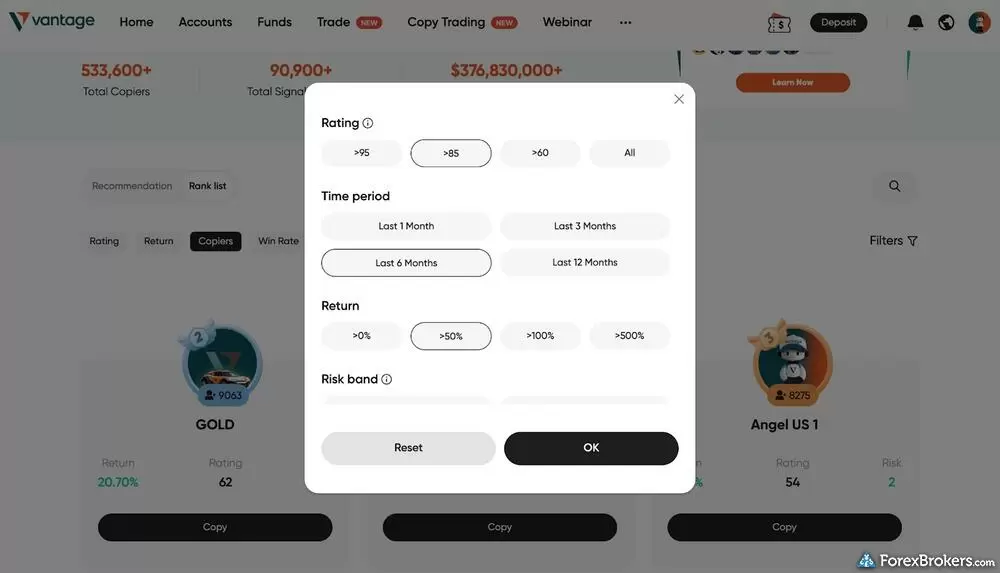

Vantage allows you to filter copy trading signal providers by Rating, Time Period, rate of Return, and more.

3. AvaTrade – Mobile-first social trading powered by Pelican

| Company |

Copy Trading |

MetaTrader 5 (MT5) |

cTrader |

AvaTrade AvaTrade

|

Yes |

Yes |

No |

AvaTrade is a trusted global brand best known for offering traders an extensive selection of trading platform options, including for copy trading forex, alongside access to a wide variety of markets, such as options and - most recently - futures trading.

Well-balanced offering: My testing found AvaTrade to be great for copy trading, competitive for mobile, mostly in line with the industry average for pricing and research, and an outstanding choice for investor education. Experienced active traders may also be interested that more competitive pricing is available at AvaTrade on its Pro account for clients that are designated as Professional traders.

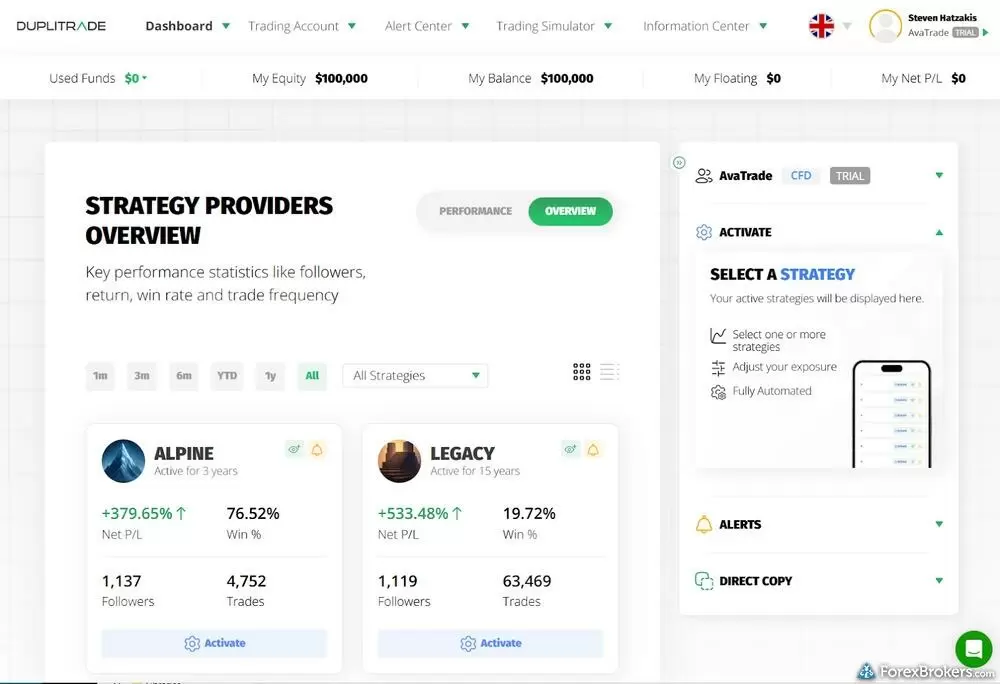

Platform selection for copy trading: Alongside MetaTrader which supports the signals markets for copy trading, AvaTrade offers ZuluTrade and DupliTrade, and recently launched AvaSocial for social trading. The wide variety of platform options is one reason that AvaTrade is a great choice for copy trading. I found it easy to connect my DupliTrade account from within the AvaTrade web platform.

AvaSocial powered by Pelican: AvaSocial is the latest copy trading platform from AvaTrader. It is developed and powered by Pelican which brings its own network of traders from around the world. Typically when brokers launch a new copy trading platform from scratch it can take many months and even years to amass a large enough network and trading history to provide clients with a substantial list of the best-performing traders to copy. However, that is not the case at AvaSocial since you can scan from among all the expert traders currently in the entire Pelican network. Check out my full review of AvaTrade for the complete rundown.

Important note: Because Pelican is a mobile-only app, AvaSocial is only available on mobile devices.

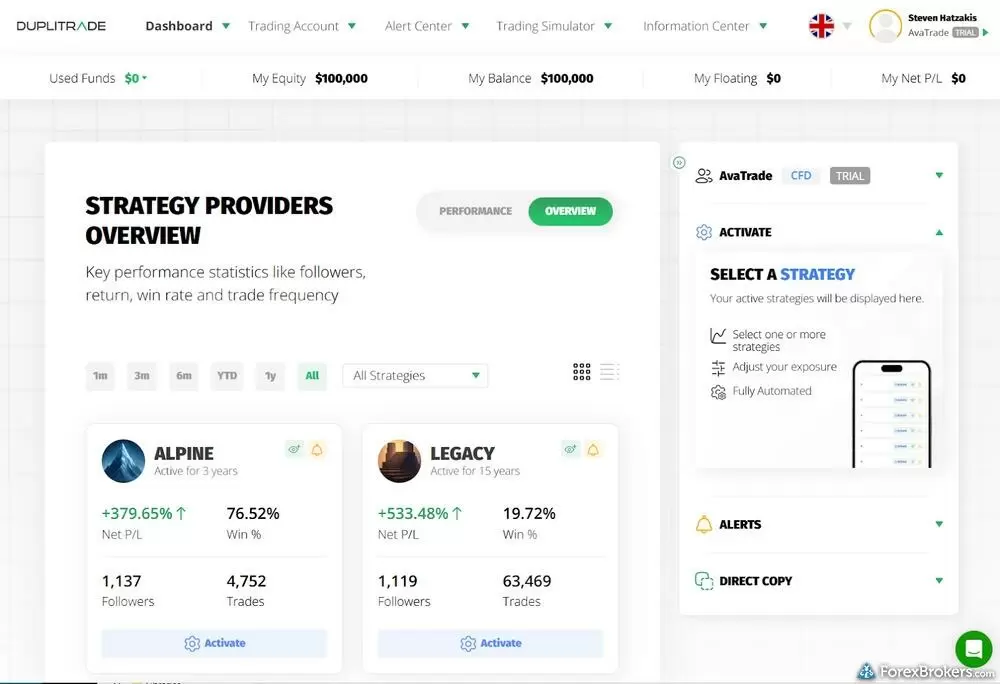

Using DupliTrade, you can review key performance indicators of Strategy Providers, such as Net P/L, number of strategy followers, and number of trdes placed.

4. Pepperstone – Lots of third-party copy trading add-ons

| Company |

Copy Trading |

MetaTrader 5 (MT5) |

cTrader |

Pepperstone Pepperstone

|

Yes |

Yes |

Yes |

Pepperstone has long been a provider of copy trading platforms from popular third-party developers and recently launched its own branded version powered by Pelican (available exclusively on mobile).

Pricing flexibility and add-ons: What helps make Pepperstone a great choice for copy trading is its vast selection of copy trading platforms and the ability to use either its spread-only standard account or commission-based Razor account across all its platforms. Each platform also comes with a plethora of third-party add-ons at Pepperstone, enhancing the available features beyond the vanilla offering of many other brokers.

Copy trading platform selection: Pepperstone’s dual offering of Signal Start for MetaTrader and DupliTrade for cTrader is a great fit for copy traders and algorithmic traders alike. In addition, cTrader also has its own native copy trading (which continues to improve, year-over-year). In partnership with Pelican, Pepperstone also offers "CopyTrading by Pepperstone." CopyTrading by Pepperstone would be my top choice at Pepperstone when looking to copy trade, simply because of the size of the Pelican network that you can access to analyze other traders to copy.

5. IC Markets – Best for algorithmic copy trading

| Company |

Copy Trading |

MetaTrader 5 (MT5) |

cTrader |

IC Markets IC Markets

|

Yes |

Yes |

Yes |

IC Markets is a great option due to its strong combination of copy trading platforms and a low-cost trading environment, making it an excellent choice for algorithmic traders who also want access to social trading tools.

Platform variety: The broker supports a wide range of copy trading platforms, including ZuluTrade, Myfxbook AutoTrade, and MetaTrader's native Signals market. IC Markets also recently launched IC Social, its mobile-only copy trading app powered by Pelican Exchange.

Platform integration: Whether you trade on MetaTrader, cTrader, or TradingView, IC Markets makes it easy to integrate copy trading into your workflow. I especially appreciate the availability of cTrader Copy, which is built for strategy-following and runs alongside tools like Autochartist and Trading Central. It’s clear that IC Markets is targeting traders who want powerful tools without the overhead of managing complex systems from scratch.

Pricing: Competitive pricing and fast, scalable execution give IC Markets a performance edge especially for high-frequency or spread-sensitive strategies.

How to get started with copy trading

Filter for consistency over raw returns

When you first view a platform's leaderboard, it's tempting to focus on the traders with the highest percentage returns. However, triple-digit gains in a short period often indicate unsustainable, high-risk behavior. Instead, filter for consistency. Look for signal providers with a track record of at least 12 months and a low "maximum drawdown" – a metric that shows the largest peak-to-valley drop in their account balance. You are looking for a smooth curve, not a volatile roller coaster.

Diversify your allocation

It's generally unwise to allocate your entire copy trading budget to a single signal provider, regardless of their past performance. A balanced portfolio typically includes three to five different traders who focus on different markets. For example, if one provider specializes in volatile cryptocurrency assets, you might balance them with a trader who focuses on low-volatility major forex pairs or blue-chip stocks. This ensures that a downturn in one specific sector does not jeopardize your entire account.

Establish strict risk limits

Regardless of the platform you choose, risk management in copy trading generally operates on two levels.

The first is the trade level: individual positions often carry their own stop-loss and take-profit orders. Some platforms, like eToro, even make it mandatory to attach a stop-loss to every trade, whether it is manual or copied.

The second layer is the strategy level: you can typically set a "hard stop" or maximum drawdown limit for each trader you copy. Crucially, these personal risk controls can cause your results to differ from the signal provider's. For example, if you are copying a strategy with a historical drawdown of 10% but you set your own hard limit at 8%, your system will override the provider and liquidate your positions once that threshold is reached, protecting your downside but potentially exiting before a recovery occurs.

Monitor and rotate

Remember: Copy trading is not a "set it and forget it" strategy. Review your portfolio's performance on a weekly basis to ensure the traders you are following are sticking to their stated strategies. If you notice a provider drastically changing their behavior—such as suddenly increasing their trade size to recover a loss (a risky practice known as "martingale")—it is often best to stop copying them and rotate that capital to a more disciplined provider.

FAQs

What is copy trading?

Copy trading is a form of trading where you automatically copy trades placed by another investor in real-time. It’s also known as social trading or mirror trading, and it’s become especially popular in forex markets. Rather than placing trades yourself, you choose experienced traders, also called signal providers, to follow. When they trade, your account mirrors their moves based on your selected risk and capital allocation settings.

What makes copy trading appealing is its accessibility. Even if you’re new to forex, you can copy trades from skilled traders and build a diversified strategy without needing to master every chart or indicator. Most copy trading platforms make this process seamless by offering performance analytics, risk controls, and social features to help you find and follow top-performing traders.

While the concept is simple, choosing the right copy trading broker, and the right traders to follow, makes all the difference. That’s why I evaluate each platform not just on features, but on the quality of their signal providers, regulatory safeguards, and the transparency of their performance data.

Is copy trading legal?

Copy trading is legal in most countries, as long as the broker itself is properly regulated. When investing in financial markets through a regulated broker, there are procedures in place during the account opening process that should ensure it is legal for you to trade (depending on your country of residence).

For example, copy trading is fully legal in the U.S. – provided that your broker is properly regulated by either the Commodity Futures Trading Commission (CFTC) in the case of forex or the Securities and Exchange Commission (SEC) for stocks. For cryptocurrency copy trading, your broker must be a registered Money Services Business (MSB) and licensed by FinCEN. In legal terms, copy trading is typically treated as a self-directed account.

Before copy trading existed, a power of attorney form was required to authorize a fund manager to trade on your behalf. Today, individual investors agree to a Letter of Direction (LoD), which is a form that authorizes the broker to copy the trades of other traders automatically based on your explicit instruction.

Fun fact: The LoD (which is now incorporated in each platform’s terms and conditions) was a crucial piece of the innovation that helped legalize copy trading in the U.S., making it largely indistinguishable from a regular self-directed brokerage account. That said, in certain countries, there are still restrictions. In the U.K., for example, additional money-management licenses are required for copy trading.

mapLooking for a copy trading broker in the U.S.?

Check out my guide to the best forex brokers in the U.S. to learn about legal forex trading for U.S. residents, and to see my picks for the best U.S. forex brokers that are regulated for forex trading.

How do you copy trade?

If you want to start copy trading, your first step will be to choose a copy trading platform. Copy trading platforms allow users to automatically copy trades in real-time using individually customized account settings and platform tools. Next, you’ll need to choose a trader to copy. People that make their trades available to be copied in real-time are known as signal providers. Once you’ve chosen a signal provider, you’ll need to decide to what degree you want to copy the signal provider, and how much capital to allocate.

How to start copy trading, in 7 steps:

- Compare the performance rankings and statistics of a variety of signal providers.

- Select a signal provider that complements your own trading goals and risk tolerance.

- Determine how much of your account balance to allocate towards copying the provider’s trades.

- Fine-tune your risk management settings and consider whether you’ll copy the provider’s existing open positions, or only new positions moving forward.

- Once you are comfortable with the settings you have configured, click to copy trade the traders you have decided to follow.

- Monitor the performance of your trading account as often as needed, depending on the frequency of trades established in your copy trading account.

- Adjust your parameters and subscriptions as conditions change (such as signal provider performance, or your own market expectations.

cell_towerPro tip:

The best signal providers typically have a large following, an established track record of performance (i.e., history of monthly trading results), consistent risk-adjusted returns, and above-average overall results. That said, the past performance of any provider is not a guarantee of future results.

How much money do I need to start copy trading?

Most copy trading platforms let you begin with as little as $100, but how much you invest should depend on your personal risk tolerance and financial goals. Starting small gives you room to get comfortable with the platform and the performance of the traders you choose to copy.

When you copy a trader, your positions mirror theirs in proportion to the amount you allocate. For example, if the signal provider opens a trade worth $10,000 and you’ve allocated 10% of that, your trade will be sized at $1,000. Having more capital allows for better diversification across multiple traders and strategies, but never risk more than you’re willing to lose.

What are the risks of copy trading?

Copy trading carries the same risks as any form of trading, with the added complexity of relying on another trader’s decisions. Even experienced signal providers can hit losing streaks or change their strategy without notice. Past performance is never a guarantee of future results, and blindly following a top-ranked trader can lead to unexpected losses if you haven’t done your due diligence.

There’s also the risk of overexposure if you allocate too much to one trader or strategy. It’s important to monitor your account, set clear risk limits, and diversify where possible. Copy trading isn't a set-it-and-forget-it solution; it requires regular oversight and smart allocation to manage risk effectively.

Is copy trading good for beginners?

Copy trading can be good for beginners, provided they learn the basics and approach copy trading the same way they would any other self-directed trading account. Beginners should always start small before trading more seriously with larger amounts, and it’s always wise to learn how to use the copy trading software with a demo account before diving straight into live trading of any kind.

It's important to note that copy trading still requires active account management — it's not a quick fix or an easy way to make money. Copy trading should be thought of as a way to complement your portfolio and existing trading tool arsenal.

Whether or not copy trading is a good idea for you will depend on your preferences, trading goals, and risk tolerance. You'll need to specify various risk/reward parameters and maximum drawdown thresholds and decide which providers to copy (if any).

Beginners should analyze all available performance metrics when deciding whether to copy a particular signal provider. Understanding a given signal provider’s risk tolerance is just as important as measuring their average profits or their overall results. It’s also important to look at a signal provider’s trading volume and frequency, and to decide whether their style of trading would be suitable for your own account balance, profit goals, and risk tolerance.

Remember: Copy trading is not a replacement for self-directed trading, and should not be thought of as a passive investment or managed account.

What is the difference between copy trading and social trading?

Copy trading and social trading are often talked about like they’re the same thing, but there’s a key difference. With copy trading, your account automatically replicates the trades of another investor in real time. Once you choose a signal provider and set your parameters, trades are placed in your account without any further action required.

Social trading, by contrast, is more about community. It gives you access to a social feed, trader profiles, and performance stats so you can follow, comment, and interact before deciding to copy. You can choose to trade manually based on insights from other traders or start copying them directly. Most copy trading platforms today include social features, blurring the line between the two.

Our testing

Why you should trust us

Steven Hatzakis is a well-known finance writer, with 25+ years of experience in the foreign exchange and financial markets. He is the Global Director of Online Broker Research for Reink Media Group, leading research efforts for ForexBrokers.com since 2016. Steven is an expert writer and researcher who has published over 1,000 articles covering the foreign exchange markets and cryptocurrency industries. He has served as a registered commodity futures representative for domestic and internationally-regulated brokerages. Steven holds a Series III license in the US as a Commodity Trading Advisor (CTA).

All content on ForexBrokers.com is handwritten by a writer, fact-checked by a member of our research team, and edited and published by an editor. Our ratings, rankings, and opinions are entirely our own, and the result of our extensive research and decades of collective experience covering the forex industry.

Ultimately, our rigorous data validation process yields an error rate of less than .1% each year, providing site visitors with quality data they can trust. Click here to learn more about how we test.

How we tested

At ForexBrokers.com, our online broker reviews are based on our collected quantitative data as well as the observations and qualified opinions of our expert researchers. Each year we publish tens of thousands of words of research on the top forex brokers and monitor dozens of international regulator agencies (read more about how we calculate Trust Score here).

Mobile testing is conducted on modern devices that run the most up-to-date operating systems available:

- For Apple, we use MacBook Pro laptops running macOS 15.3, and the iPhone XS running iOS 18.3.

- For Android, we use the Samsung Galaxy S20 and Samsung Galaxy S23 Ultra devices running Android OS 15.

All websites and web-based platforms are tested using the latest version of the Google Chrome browser.

Our researchers thoroughly test a wide range of key features, such as the availability and quality of watch lists, mobile charting, real-time and streaming quotes, and educational resources – among other important variables. We also evaluate the overall design of the mobile experience, and look for a fluid user experience moving between mobile and desktop platforms.

eToro

eToro

Vantage

Vantage

AvaTrade

AvaTrade

Pepperstone

Pepperstone

IC Markets

IC Markets

Tickmill

Tickmill

Exness

Exness

FXCM

FXCM